Notary Signing Agent in Tempe

When signing a legal document, it is essential the individuals who are signing it be accurately identified and acknowledged. This is where the services of our Real Estate Mobile Notary in Tempe are beneficial. For lending and title companies, we employ Notary loan signing agents that are certified to perform Notarizations for selling documents, buyer’s documents and more.

Why choose our Loan Signing Agent in Tempe

We make the loan signing procedure as simple as possible. At Arizona 1st Notary, our goal is to streamline the signing process and give the best possible service to the borrower and the title company. Besides that, our Loan Signing Agents in Tempe have received specific training on the relevance of each document in the loan signing package.

No Location Restrictions

You will not be asked to travel or work around a mobile signing agent’s schedule. We will meet you at a time and place that is convenient for you.

Availability 24 Hours

We recognize that final signatures must be obtained as soon as possible. Our signing agent will be there when you need.

Certified Signing Agent

A Certified Loan Signing Agent is a Notary Public who has extensive experience in the loan signing industry, and works closely with escrow, title, mortgage, or other real estate firms.

Notary Signing Agent Services in Tempe

Arizona 1st Notary is Tempe’s only Notary signing service that understands the goal is to make your life easier. Arriving on time guarantees that your Signing Agent Appointment starts and ends on schedule.

General Warranty Deeds

A Notary Public or other official authorized to sign acknowledgments must verify the signatures on a General Warranty Deed. If no acknowledgment or verification is given, deeds that are not registered in the land records may be void.

USA Patriot Act CIP Forms

Signing Agents are often required to sign a USA PATRIOT Act CIP form attesting to the accuracy of the NSA’s identification of the borrower. By completing this form, mortgage lenders and financial institutions may more easily comply with their PATRIOT ACT regulatory responsibilities.

Compliance Agreement

Compliance agreements are notarized and included into the closing loan package through a Jurat or Acknowledgement. Omissions and Errors Compliance Agreement guarantees that the borrower will comply with the lender’s or closing agent’s requests to fix typographical mistakes, clerical errors, or other inaccuracies in the loan documentation after the loan’s closure.

Borrower Affidavit

The borrower must sign this paper in the presence of a notary public. Additionally, the borrower certifies in the document that they have committed no acts that jeopardize their property’s title, such as they are not the subject of divorce or bankruptcy proceedings, and so on.

Limited Power of Attorney/Correction Agreement

The Limited Power of Attorney would allow corrections to be made on the signing parties behalf without the inconvenience of an additional signings. These are known as Correction Agreement Limited Power of Attorney’s for real estate documents.

Signature Affidavit

A signature affidavit is a document that an individual will sign to affirm their legal name is correctly stated and typed in the affidavit. Additionally, this is a document that is common in real estate documents known as a borrower’s Signature Affidavit as well as other legal documents. These must be signed in the presence of a notary public.

Affidavit of Ownership

An Affidavit of Ownership is a type of legal documentation stating the ownership of a specific piece of property such as a house or car. This type of legal documentation is used in cases that a title or deed is not sufficient enough evidence. An affidavit of Ownership is generally used if you acquire a piece of property through inheritance or can make it understood how that property was purchased.

Refinance Loans

It’s perhaps the most common loan signature. When a borrower refinances, he or she replaces an existing loan. A homeowner refinances their property in order to lower their loan interest rate or to cash out equity.

- Document Correction Agreement

- Limited Power of Attorney/Correction Agreement

- Borrower’s Closing Affidavit Borrower

- Marital Status Affidavit

- Homestead Affidavit

- Refinance Loans

Benefits of using Arizona 1st Notary Signing Agent Services in Tempe, Az

Upfront Pricing and Invoice later

For Title companies and lenders our affordable Mobile Notary services come with upfront, transparent pricing.

Knowledgeable Signing Agent

As a Notary Signing Agent, we guarantee that all signings will be completed accurately.

Need a Signing Agent Service in Tempe?

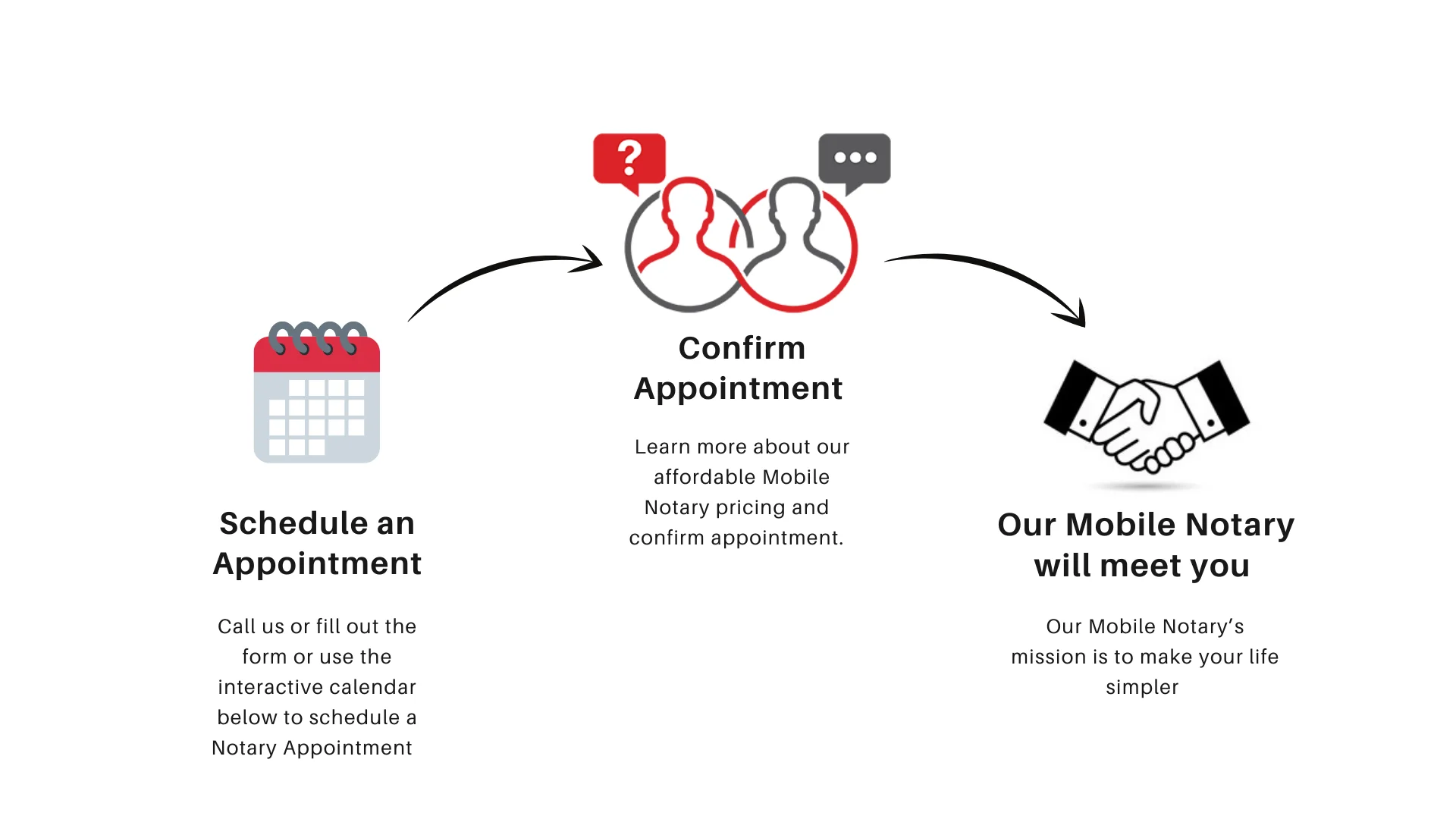

Schedule a Notary Signing Agent appointment using the form or give us a call.

In terms of health, we closely follow local and national authorities’ advice and keep an eye on Coronavirus for more news alerts to ensure that we can continue to provide Signing Agent services in Tempe Arizona.